Every development team understands that time is money—but few quantify just how expensive time really is. Before a single line is drawn or a site is purchased, weeks are spent verifying zoning codes, adjusting layouts, and running yield calculations. Each of those steps carries a cost: consultant fees, holding expenses, and missed opportunities.

Across typical mid-scale projects, feasibility studies can cost $5,000-$15,000 USD for small-scale residential developments (Lumina). The cost can go as high as $500,000 USD for other large scale projects (Aninver). In today's market, speed isn't just a productivity metric—it's a financial variable. The faster a team can validate assumptions and act with confidence, the lower its exposure to changing market conditions, escalating land costs, and competitive bids.

That's where real-time feasibility changes the math. By compressing weeks of manual coordination into hours of automated analysis, AI-driven tools are transforming feasibility from a cost center into a measurable source of return—proving that in development, speed is strategy.

Quantifying the Cost of Traditional Feasibility

Traditional feasibility workflows rely on multiple rounds of site studies, spreadsheets, consultant coordination, and manual yield calculations. These iterations introduce delay and cost. As one industry article notes: "many of these delays originate much earlier; during the planning, design, and feasibility stages." Pankaj Srivastava, PODIUM

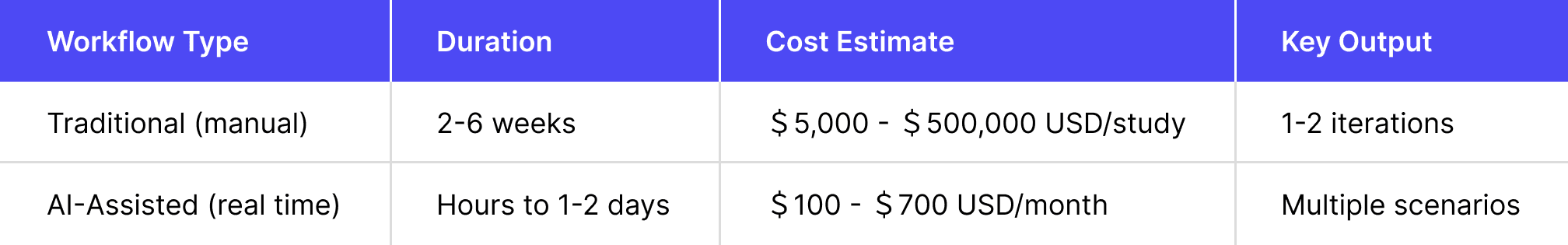

The contrast between traditional and real-time feasibility becomes clear when viewed side by side:

The AI-assisted range reflects publicly listed subscription pricing across tools in the feasibility and generative-design category, including ArkDesign, Archistar, and others.

While precise time-savings data is sparse, one study in architecture noted that AI enabled a design configuration change that raised projected ROI from ~9 to ~15 percent (Cove). The implication: when you shorten feasibility timelines, you not only save cost—you improve outcomes.

Industry research indicates that total holding costs for land and financing generally range from 0.5 to 1 percent of property value per month, incorporating interest, taxes, and insurance. A substantial portion of these costs arises from financing, as interest on land acquisition or construction loans typically ranges between 5 and 12 percent annually, depending on jurisdiction and lending structure, which equates to roughly 0.4 to 1.0 percent per month. Reducing even a single month of feasibility delay can therefore yield savings in the tens or hundreds of thousands of dollars, depending on project scale and financial exposure.

The Speed Dividend – How Real-Time Feasibility Changes the Math

Real-time feasibility is not just about doing the same task faster; it is about redesigning the decision loop. Findings from "Economic Analysis of the Real Estate Market Using Artificial Intelligence" highlight that the application of AI in real estate can lead to lower transaction costs, higher rental yields, and improved investment returns (Khani Dehnavi et al., 2025).

Key advantages include:

• Faster site validation: When a site can be evaluated in days instead of weeks, the acquisition team can act sooner—securing land or negotiating earlier.

• Reduced consultant cycles: Fewer manual iterations and fewer external experts translate to lower hard costs and faster approvals.

• More scenario testing: Real-time tools enable numerous rapid-fire "what-if" analyses—unit mixes, building forms, density—achieving in hours what conventional feasibility processes often take days to produce.

For example, tools like Zenerate allow teams to adjust key variables including building height, program mix, and cost assumptions, with immediate visual and numerical feedback that reveals how each change affects both design and financial performance.

• Improved stakeholder alignment: With faster feedback, design, finance and acquisition teams remain synchronized—reducing miscommunication and decision delays.

Consider this scenario: A midsize residential team typically spends two weeks on early feasibility analysis, with internal time and external consultant fees totaling a certain amount. The adoption of real-time feasibility cuts the evaluation time to one day, eliminates external consultants for the first round, and allows the team to evaluate an extra site in the same quarter. That extra site became possible because feasibility no longer blocked the pipeline. The outcome: lower cost per study, more rounds, more options, faster execution.

Beyond Time Savings: The Strategic ROI

Faster feasibility timelines drive strategic outcomes that extend well beyond cost savings. Key strategic benefits:

• Larger and more active pipelines: When feasibility is faster, teams can evaluate more sites per period, increasing the selection quality and deal volume.

• Reduced risk of late-stage surprises: Early validation of zoning, yield and cost assumptions means fewer negative surprises later (e.g., entitlement issues, redesigns).

• Better resource allocation: When repetitive feasibility tasks are shortened or automated, staff and consultants can shift focus to higher-value work—design innovation, market strategy, or client engagement.

• Stronger investor/developer credibility: Presenting data-backed scenarios early in discussions builds confidence among acquisition, finance and investment partners. AI-driven rapid tests become proof points rather than slow deliverables.

In sum: The financial benefit of speed multiplies when you factor in competitive advantage, resource leverage and stakeholder alignment.

Implementation Considerations

While the value of real-time feasibility is clear, successful implementation requires data readiness and operational alignment. Cove highlights this: AI enables rapid analysis and scenario testing, but only when structured inputs and clean datasets are available.

Best practices include:

• Instituting structured zoning and site-input workflows so variables (density, FAR, setbacks) are captured cleanly.

• Ensuring cross-team alignment so design, finance and acquisition speak the same metric language.

• Selecting platforms that allow rapid scenario testing rather than rigid workflows.

• Building internally the discipline of decision speed: if feasibility delivers in hours, the team and process must respond accordingly.

The Economics of Speed

In real estate development, time is capital. Doing things faster is not just about being efficient—it directly impacts profitability, risk exposure, pipeline velocity, and competitive positioning.

AI-enabled real-time feasibility transforms what was once the slowest part of a project into a strategic advantage. It enables teams to validate sites, iterate designs and align stakeholders while others are still waiting for the first draft.

In an industry where conditions evolve week by week, speed is no longer optional—it is a differentiator.

If your team is investing in tools that reduce the time from concept to decision, you're not just saving hours, you're capturing real value.

Bring Real-Time Decision-Making Into Your Feasibility Workflow

The value of faster feasibility is measurable: lower holding costs, fewer redesign cycles, stronger stakeholder alignment, and a more direct path from concept to investment. Zenerate brings these advantages into a single real-time platform, enabling teams to input zoning data, test scenarios, and evaluate design and financial outcomes in minutes rather than weeks.

With real-time feedback, teams can explore scenarios, refine ideas, and advance decisions without losing momentum.

See how real-time feasibility can reshape your development process—schedule a demo below.